Regulation of Live Collateral Mortgages

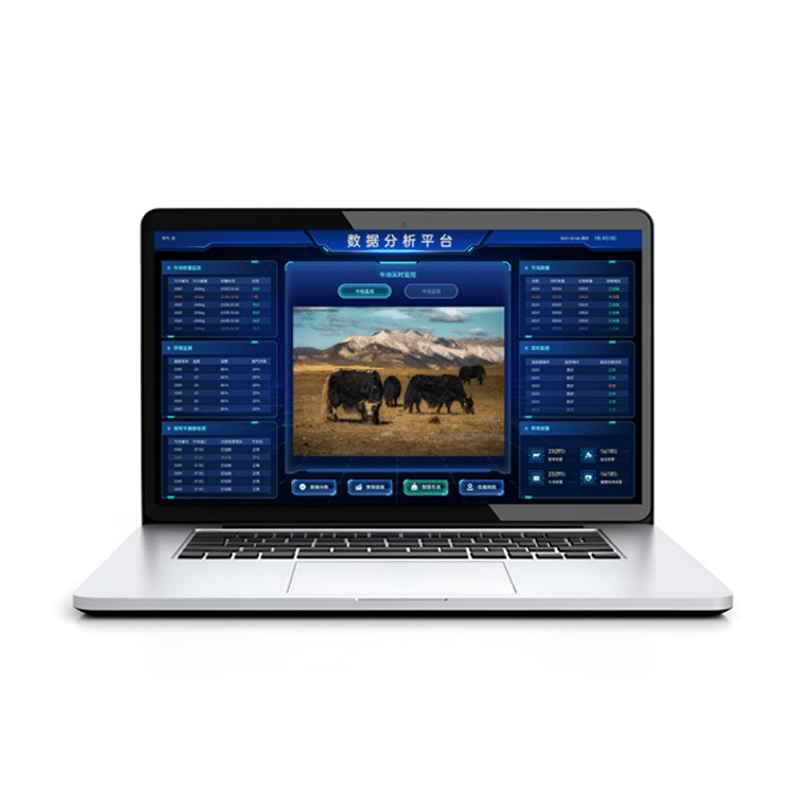

Real-time intelligent alerts for credit risk, enabling precise prevention and control

Customer Pain Points

1. Pre-loan Title Verification - Challenges in Mortgage Registration

Since collateral assets are living creatures, it is impractical to conduct low-cost identification and quantity registration of live animals. During the breeding process, they may be replaced by other livestock, resulting in the collateral no longer being the same live assets pledged when the funds were originally injected.

2. Value Assessment - Assets Undergo Frequent Changes

The value of biological assets is subject to significant price volatility due to factors such as the scale of trading markets, shifts in supply and demand conditions, and variations in growth cycles, necessitating higher standards and requirements for valuation.

3. Post-loan Monitoring - Challenges in Risk Control

Banks face challenges in verifying and controlling live collateral during post-loan management, as they cannot monitor the quantity and condition of livestock in real time. This creates risks such as farmers disposing of collateral without authorization or unexpected deaths of pledged animals.

4. Risk Sharing - High Lending Costs

To mitigate credit risk, banks collaborate with insurance companies, guarantee firms, or third-party regulatory bodies to establish a risk compensation mechanism for collateralized loans secured by living assets. This collaboration clarifies the rights and obligations of all parties involved but indirectly increases lending costs.

Solution Description and Key Products

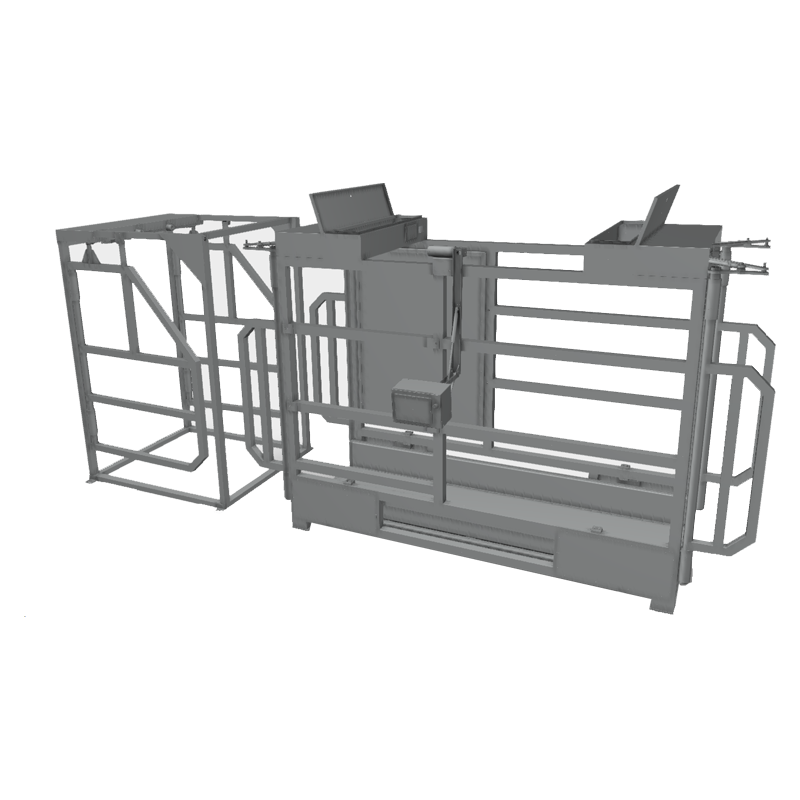

Through three core functions, we provide end-to-end protection for livestock collateral loans: Pre-loan, leveraging IoT devices like smart ear tags and collars to assign each animal a unique lifetime electronic ID. Simultaneously, we establish foundational records containing breed, birth date, and other details, enabling dynamic “one animal, one tag” management to resolve asset ownership verification challenges. Post-loan, smart pens equipped with high-definition cameras enable financial institutions to remotely monitor livestock conditions 24/7. The system dynamically collects data on livestock count, body temperature, and weight, providing real-time collateral status updates to overcome supervision and monitoring challenges. Leveraging big data and artificial intelligence, the system continuously monitors livestock health and inventory levels. It triggers immediate alerts for anomalies like mortality or escapes, establishing a robust risk warning mechanism that effectively mitigates lending risks for banks.

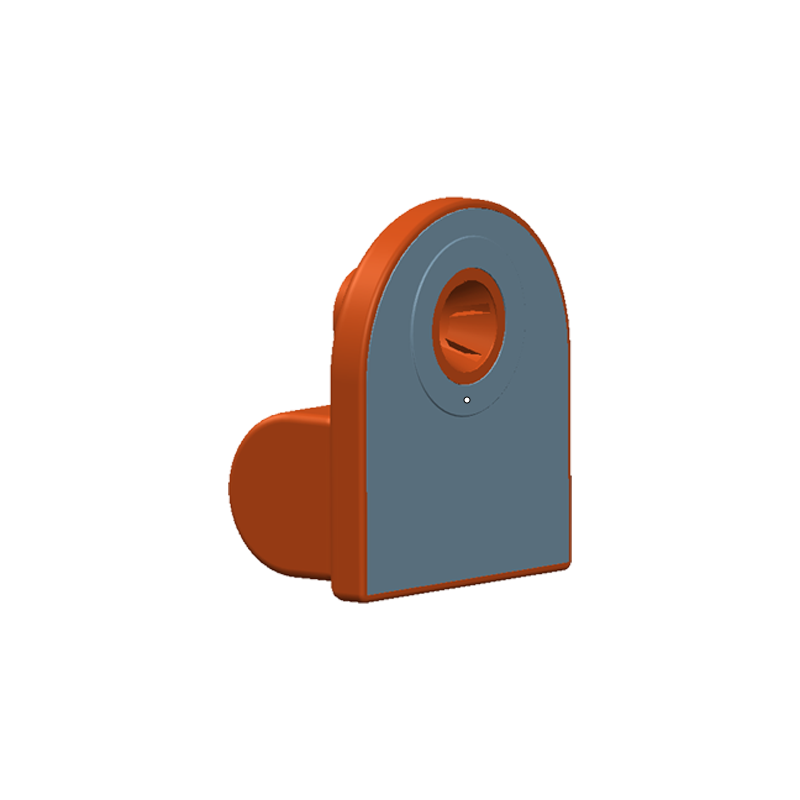

Hardware products

Delivering core value to our customers

1. Government Side: Data-Driven Empowerment of Livestock Regulation

Real-time monitoring of livestock numbers, locations, physical conditions, and disease status enables data-driven precision management in animal husbandry, enhancing industry oversight efficiency.

2. Banking/Insurance Sector: Real-time Collateral Risk Prevention and Control

Track loans and livestock insurance status throughout the entire process, precisely monitor numbers and locations, and receive instant alerts for anomalies (deaths/boundary breaches) to fortify financial risk control defenses.

3. Group Company Side: Dual Safeguards for Assets and Epidemic Prevention

Monitor livestock numbers and health status at affiliated farms in real time, implement precise loss prevention and rapid deployment of disease control measures to safeguard the security of your livestock assets.

4. Farm End: Precision Farming Boosts Efficiency

Monitor livestock inventory in real time, detect disease and estrus early, optimize production processes, reduce costs while boosting efficiency, and enhance core farming profitability.

Benchmark Case